The National Institute of Securities Market (NISM) in collaboration with the Department of Commerce, School of Economics, Commerce and Management, Martin Luther Christian University organised a 10-hour Financial Literacy for youth on June 6-7, 2023 at the MLCU Umsawli Campus.

The following are the objectives of the programme:

- Creating awareness of personal finance framework.

- Awareness of pre-requisites for investing in securities markets.

- Understanding of precautions and awareness of risk involved while investing in securities markets.

- Capacity building for evaluation of investment opportunities in securities markets.

- Awareness of employment opportunities in financial service industries

- Creating awareness of self-employment opportunities viz. investment advisors or authorised persons of brokers.

- Empowerment of students for facing interviews with financial services industry employment opportunities.

Introduction

The National Institute of Securities Market (NISM) is a public trust which was established in 2006 by the Securities and Exchange Board of India (SEBI), the regulator of the securities market in India.

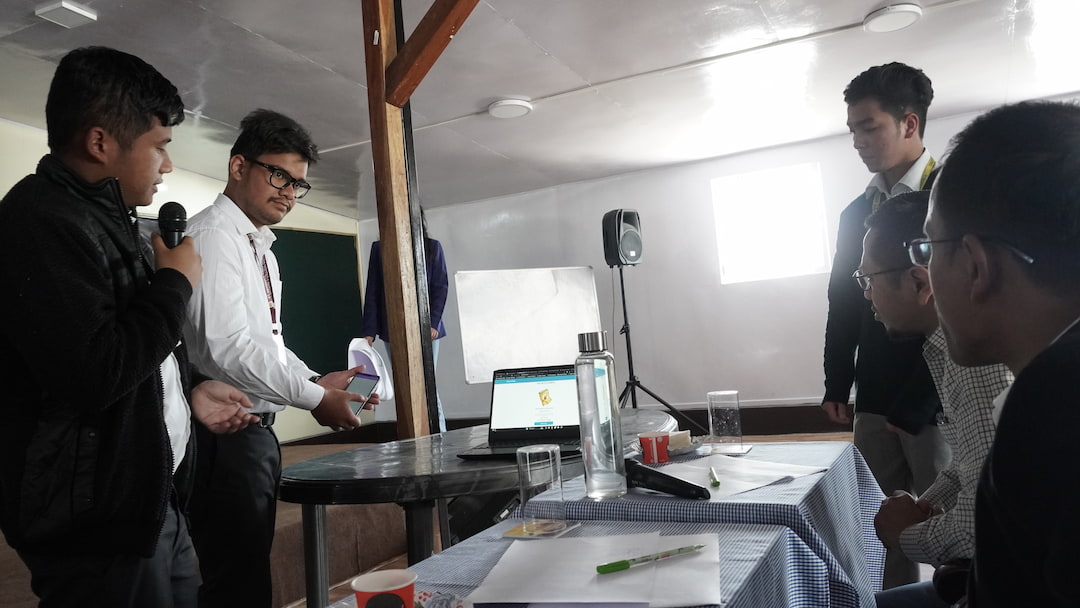

Dr. Akeekurrehman, Resource Person, NISM briefly explain the role of NISM and the opportunities it has created for youth to invest and earn money by investing in the stock market. He enlightened on investing in the world of the stock market, to protect investing from fraud and jobs availability in the financial world.

Dr Akeel explained further to students the requirements such as documents to enter this vast financial network and how to invest and trade. The workshop discussed how youth should start investing now to reap the benefits in the future since they have the future ahead of them.

Summary of Sessions

The following topics were covered during the two-day workshop.

- Session I – Importance of Investment

- Session II – Financial Investment Opportunities

- Session III – Process & Pre- requisites to invest in Securities Markets

- Session IV – Investment in Primary Markets

- Session V – Investing in Secondary Markets

- Session VI – Introduction to Mutual funds and ways to invest in them

- Session VII – Precautions while Investing in Securities Markets

- Session VIII – Career in Securities Markets.

Key Learnings

- Different types of investing vehicles were discussed during the workshop.

- The workshop covered different methods of investing and documentation required for opening a demat account.

- Students were informed on the value of early investing and the role of compound interest in wealth generation.

- Students were also informed about the numerous career avenues available in the securities market and the certification courses provided by NISM.

- It informs students to start investing early with a small amount of money, such as with a systematic investment plan (SIP), and have long-term goals in investing.

Conclusion.

The Financial Literacy workshop was an eye-opener and provided a much-needed impetus towards learning more about investing in the stock market. The speaker was very knowledgeable and made every effort to ensure all students learn the basics of investing. The workshop has enlightened students to start working from home and make money by trading and students have acquired knowledge about investing and a careful analysis of investment. However, despite all efforts by the university and speaker, the benefit of such a workshop can only be judged by students’ receptivity and further action.